As of December 2022, inflation is still running higher-than-ideal at 6.5%. Time to raise prices? Maybe. Let’s think this through.

Pros: The Case For Raising Prices

There are a number of good reasons why price hikes may be in order.

Inflation

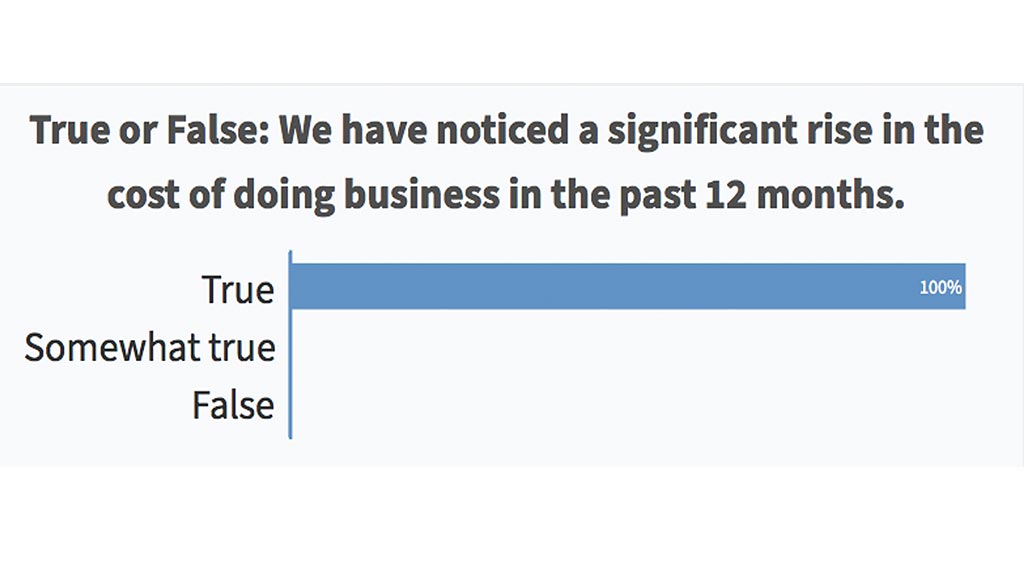

In December, the Consumer Price Index, considered a reliable barometer of inflation, fell a bit to 6.5%, not ideal, but better than it was in June when it was running at 9.1% According to the Consumer Price Index, If you compare the purchasing power of a dollar in December 2021 with the same dollar in November 2022, the latter has 6.5% less buying power. That is to say, if you haven’t increased your prices by at least 6.5% since the end of last year, your revenue growth is not keeping pace with inflation and your profits are not worth what they used to be. During the 2022 veterinary education conference year, most veterinary audiences polled said they were experiencing a higher-than-normal rise in the cost of doing business.

Outside of the glaring devaluation of currency, inflation can impact small businesses in more subtle, but still important ways. Remember that inflation means the loss of buying power over time, but this also applies to the value of debt. So, if you are a debt holder, your obligations are worth less than what they used to be. Perhaps you own a home. In an inflationary cycle as wages and prices rise, inflation can boost the value of your home and your paycheck while at the same time chipping away at the value of your mortgage. This means that mortgage holders get to pay back debt that is worth less than when they borrowed it and can pocket the difference.

Demand

Haven’t you heard? Pets are in. So much so that in 2021, vet professionals coined the phrase pandemic puppies and COVID kitties. During parts of 2020, some animal shelters ran out of adoptees! In a 2021 national poll conducted by VitusVet, veterinary professionals overwhelmingly agreed that demand for veterinary care had surged. On the flip side, veterinary workers are still pulling back on their schedules for all kinds of reasons. The result? Lots of demand for veterinary care, but short supply, and… a perfect opportunity to raise prices.

Increased Wealth

Mortgage forbearance, extended unemployment, two rounds of stimulus checks, expansion of the child tax credit, a surge in stock value, historic low interest rates, and decreased spending have left consumers, at least the ones in the upper quintile, wealthier than they have been in decades. While there is mounting evidence that a significant portion of this wealth is washing out as quickly as it rolled in, some are still feeling flush with cash.

$1000

$1000 referral fee for veterinarian applicants. Sign on bonuses also available. More.

Higher Wage Demands

Pandemic-related, country-wide staffing shortages persist and are forcing veterinary managers to pay higher wages and offer better benefits. Unless you want these additional expenses to come out of your take-home profits, you’ll have to raise your prices.

Cons: How Price Increases Could Blow Up In Your Face

Prospects of Future Sluggish Economic Growth

There are mounting concerns that inflation combined with the Federal Reserve’s response of aggressive rate hikes will push the economy into recession in 2023. Still-high inflation could support an argument for higher prices now, but recession later in 2023 could mean that significant part of your client base might not be able to afford the changes later in the year. In short, what if you raise prices now, but discover that by October you overshot the mark of what your clients can afford.

Uneven Distribution of Wealth

While it is true that the upper quintile of consumers emerged from 2020 with more wealth, the lower quintile faired worse than ever. As we move into 2023, Transunion, one of the biggest consumer credit agencies, predicts that more Americans will fall behind in loan repayments in any time since 2010. A price hike may be fine for your wealthier clients, but out of reach to those that were barely making ends meet prior to the pandemic?

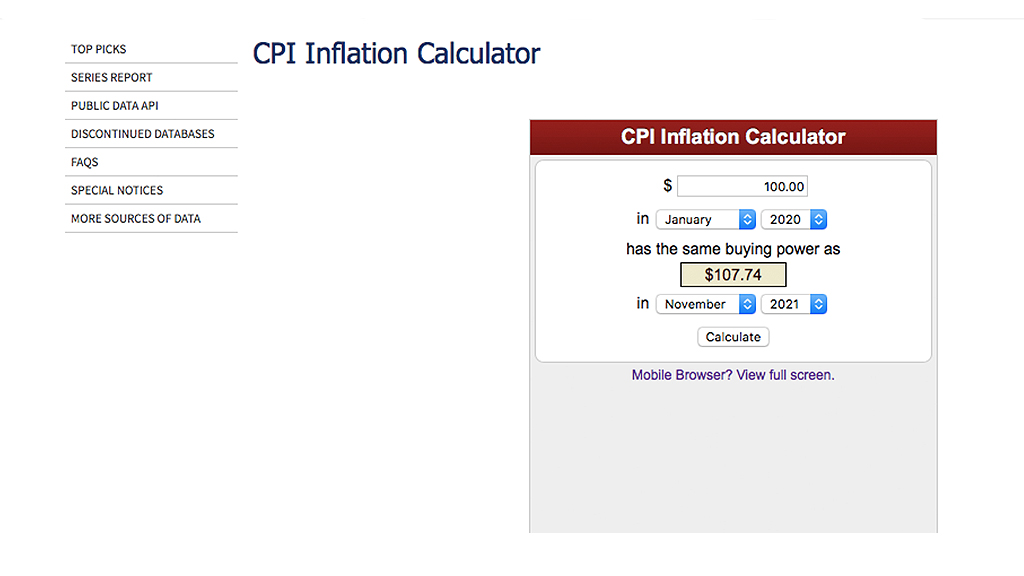

Your Prices Are Already Disproportionately High

In the face of overwhelming demand, many veterinary leaders have already dramatically increased prices. In fact, I would argue that it’s become too easy of a default. Consequently teams have lost sense of the value of what we charge, and some clients, watching what appear to be arbitrary price hikes from the sidelines, have grown wary that are trying to take advantage. Fortunately there is a way to test your price changes, albeit in a very broad stroke manner, by using the Consumer Price Index Inflation Calculator. This handy, free online tool calculates the difference in value between a dollar today and any other time in history. As an example, you can use the calculator to compare the buying power of $100 dollars in January 2020 to see that its January 2023 equivalent would be $115.05 In other words, you need ≈ $115 dollars in 2023 to buy the same amount of stuff that you could buy in 2020 with 100 dollars, a difference of 15.05%. In the most basic terms, if all of your prices haven’t increased by an average of 15.5% in the past 23 months, your business’s growth is not keeping up with inflation. For more on the specifics of the CPI and the many ways you can use it to understand inflation and pricing, go their FAQ page.

Inflation’s Impact On Fixed Incomers

As inflation drives up prices everywhere, fixed incomers are squeezed between a static income and universal climbing costs. If you raise prices, your services are that much more likely to be out of reach for this group of consumers.

Distasteful Message to Staff

Veterinary professionals are notorious empathetic to pet owners who are having trouble paying for veterinary care. If you raise prices without appearing to have considered what that impact will be on clients, the price increase will seem tone deaf. Equally distasteful to your staff would be price increases without a concurrent offer to raise employee wages or hire additional support members that most veterinary crews believe that they need.

- Professional one-on-one assistance customizing your wellness plan

- Local market analysis of your pricing (a 10K value!)

- Customized marketing help

- Integrates with your PMS

- Best of all, you don’t need to bill! You collect when services are rendered!

Raising Prices: The Cost-Plus versus Value-Based Pricing System

Most practices aren’t too scientific when calculating what they believe to be fair prices for their services. They rely on what prices were charged at previous places of employment, what they believe is fair and affordable for consumers, what the competition is charging, and a ballpark estimate of how much it costs to deliver the service. This system works moderately well for many veterinary hospitals, but is most difficult to defend to the staff (whose support for your prices is vital to sales), and tends to leave a lot of opportunity on the table.

Cost-Plus Pricing Explained

To ensure that veterinary practices are covering all of the expenses that they incur when delivering a service and earning an acceptable amount of profit, many business advisors encourage hospitals to use a Cost-Plus pricing formula to decide upon prices. The formula for Cost-Plus pricing is Price = Cost ÷ (1-Desired profit margin (written as a decimal)). For example if the service you provide costs a total of 100 dollars and you want to earn a 20% margin on the price, the formula would be Price= $100/ (1-.20) or $125.00.

The issue with Cost-Plus pricing is usually the debate about what to include in the cost part of the equation. If you are administering a rabies vaccine, including the cost of the vaccine itself seems obvious, but where do you stop after that? Do you include the cost of the syringe, the cotton ball and the squirt of alcohol? What about the time the technician takes to explain the value of the vaccine to the client? What about the time it takes to administer it? What about the cost of the lights to illuminate the exam room or the money spent in rent for it? Do you also charge for the time it takes to clean the exam room after the client has left?

A few years back, there was a very popular Cost-Plus pricing calculator circulating amongst veterinary hospitals. Many practices loved the calculator because it gave them a first-ever understanding of just how much money the hospital was spending to do business. The calculator’s recommended price hikes gave veterinary teams real faith in their prices because every penny of expense was taken into consideration. Finally, here was a method to the madness!

But some found that the calculator returned overly-high price recommendations. The issue was that the calculator failed to consider overlapping services. To explain, if we see one client at a time, apportioning how many fixed costs we incur per appointment is straight forward, but what happens when we have three clients in the building at once? To be fair, shouldn’t we charge each of these clients a fraction of the fixed cost expense since we pay the same amount in fixed costs whether there is one or twenty people being served at the same time? In the absence of this consideration, the calculator often returned higher-than-necessary prices. Not necessarily bad if consumers are willing to spend the money, but what if the suggested price deterred spending? The best service price Is one that is high enough to ensure that you don’t leave opportunity for revenue on the table, but not so high as to discourage purchases.

Value-based Pricing Explained

Value-Based Pricing is like Cost-Plus pricing in that it considers costs when arriving at a final price, but also considers the following criteria:

- The emotional benefits of the service. That is to say, how much do clients feel a service is worth.

- The price that competitors charge for the same service or the reference point for what consumers believe to be fair.

- The value proposition, or the case that the practice makes for how its service is distinguished from others.

There’s one more consideration to Value-Based pricing, tangential to the criteria above, but one that is often lumped together with it none-the-less. That is, if an additional service, let’s say something like post surgical laser therapy, is added to an existing service bundle that’s already profitable, do we need to include fixed costs in determining the price of the add-on item? We’ll cover this question first and then subsequently discuss the other above-mentioned criteria.

Calculating Add-on Service Prices

If a practice is already earning a sufficient amount of profit from an annual wellness bundle, the price of an add-on service like a wellness blood profile needn’t take into consideration fixed costs because these are already covered by the price of the above-mentioned bundle. The price of the add-on can be based strictly on the cost of the blood profile alone (and perhaps the additional time the team members spend in evaluating the results, or running the test). Because the calculation for the add-on service price eliminates the redundant fixed cost expense, the final price remains low and within reach of more clients, yet still returns a significant profit.

Calculating A Service’s Emotional Value

A more challenging hurdle is calculating how much a client feels a service is worth. For example, in determining the price of a preanesthetic wellness panel, we might only consider how much the reference lab charges us to requisition the test, but what if this test were integral in ensuring that a beloved pet lived longer? In this context, doesn’t it feel to you (or to the client) that it should be worth more?

Here’s another example: A client has a pet with a persistent skin infection. The pet has seen two other veterinarians, but the problem persists. Examining the pet may take no longer than examining any other patient, but should we charge the same? If the consultation with your veterinarian includes careful consideration of the previous medical history and special attention to bonding to both the patient and the client, is it possible that the client would perceive this consultation as more valuable than an ordinary exam? If so, should we charge more for it?

Some are adamantly opposed to such reasoning, decrying it as unethical. Slide the pricing scale up or down based on the rising or falling emotions a client feels for their pet at any given time? How dare you!

I’ll leave it for you and your team to discuss, but please consider the following:

- Is an exam an exam an exam? I know the cost of the exam up the road is $55 dollars, but is it the same one that your vet, with 3 times the years of experience, performs?

- Are all trips to the vet the same? Is a trip to a vet where the pet happily wags his tail more valuable than one where the pet quakes inside his carrier?

- Are all medications the same? Is a medication worth more if the team follows through with the client to see how the pet is responding to it, then reaches out to the client before the medication is finished to offer a refill?

- Are all employees the same? You have employees that can anticipate your clients’ needs making it seem like you aren’t employing receptionists, but telepaths. Is there an added value to that?

Isolate Pricing Potential Using Benchmarks

Practice leaders have been drilling into profit for some time. Consequently there are some reliable benchmarks you can look to when deciding whether a category of your inventory or services may be primed for a price hike. Remember that there are usually nuances to all of these numbers, so if you’re not hitting a particular mark, reach out before you freak out. There’s likely a logical explanation to why your numbers aren’t adding up.

Cost of Goods Sold: The costs of good sold, or variable expenses, at a general veterinary practice are usually somewhere in the vicinity of 18-22% of total gross revenue.

Indirect or Fixed Costs: This category includes rent, utilities and other costs that are mostly stable despite business volume. These are usually 20% of gross revenue.

Support staff wages: Including payroll taxes, but not benefits, are usually 20% of gross revenue.

Doctor salaries: Doctor salaries, including payroll taxes, but not benefits, are usually 16-20% of gross revenue.

Direct Cost: Direct cost is the ratio of money spent for a group of services or products compared to the same group’s revenue. For example, if we spent 10 dollars for a pot of daisies and sold the same pot for 50 dollars, the direct costs would be 10÷50= 0.20 or 20%. That means that for every 20 cents we spend on daisies, we earn 1 dollar of revenue.

Pharmacy: 42-45%

Laboratory: 25%

Diet: 65%

How To Raise Prices Correctly At A Veterinary Practice

I have found that the best approaches to pricing take into consideration three important criteria: Costs and profit, value, and price appeal.

Costs and Profit

When determining the right price for an item, I consider both its individual costs and how the price will add up with the prices of other services with which it will likely be bundled, I do this for three reasons:

- Loss Leaders: Too many of our service items are loss leaders (vaccines, exams, routine surgeries, etc.) Calculating a price of an item without considering that some service items that its paired with are already losing money will short change us of profit.

- Total Invoice Versus Line Items: It’s the total of the invoice that we are selling to a client, not the price of individual items. In other words, no one really cares that the stool sample is ten dollars higher at your practice than it is at another practice, provided that the overall invoice for the stool sample, and all the other service items it is usually paired with, is in the ballpark of what the client thinks is reasonable.

- Easier to Calculate: It’s easier to wrap your head around the time and money involved in delivering a service bundle than it is to consider delivering each service independent of the other.

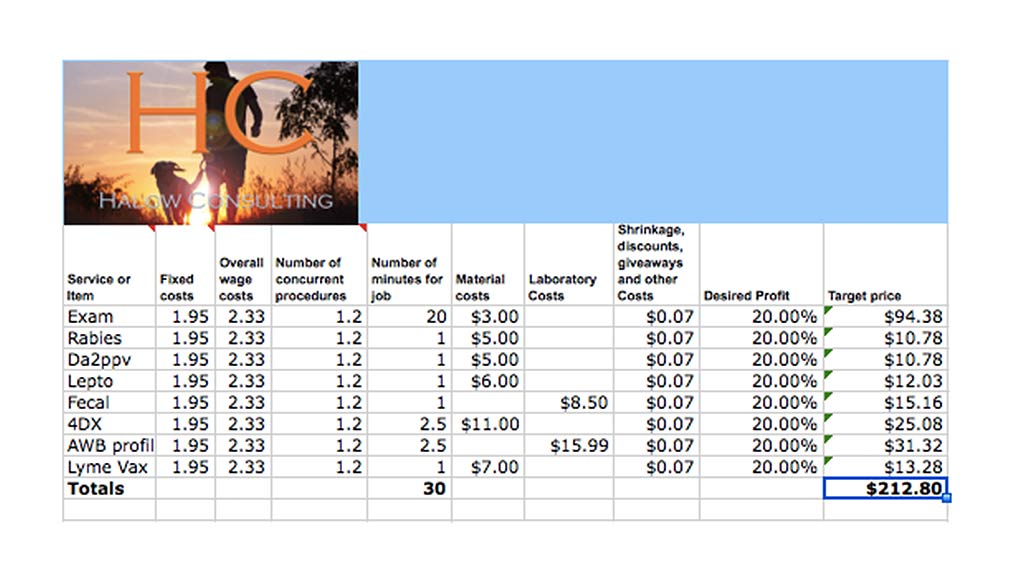

To this end, I look at common bundles of services so that I can determine if the existing prices are sufficiently profitable on their own as well as when they are grouped together. For the calculation, I use an Excel-based calculator that computes a practice’s fixed costs-per-minute, its direct costs, the time involved in delivering a service, and then adds in a desired profit on price. The calculated prices are usually significantly different from current charges, but that’s okay; it’s the invoice total that’s most important. You can explore your veterinary prices using this online veterinary pricing calculator.

This calculator helps the business manager understand the profitability of individual services and how prices work together in frequently-used bundles to create a final price point that is attractive to consumers and profitable. It’s important to consider how services work in bundles since so many of the commonly-sold services at veterinary hospitals are sold as loss leaders (for example, most practices are not charging 94 dollars for an exam). By writing in the real price for an exam, leaders can see how the prices of other services must increase in order to achieve the goal of a $212.00 invoice and a 20% profit margin for the time involved in delivering one service bundle. Click here for more information on how to calculate the fixed and overall wage costs for your practice or to reach out for a customized veterinary pricing calculator for your hospital’s use.

Value

Once you’re satisfied that your pricing is serving your business goals, take estimates for your bundled services to the team and discuss each service, not from a material standpoint, but in the context of the value that it brings to each client. For example, your surgery estimate may include a 15 dollar charge for catheter placement. If you think of a catheter as a flimsy plastic tube about the length of a hairpin, 15 dollars may seem the limit for what you believe you can charge, but if you think of it as part of an anesthetic safety package that saves pets’ lives, suddenly 15 dollars seems like a deal. Talk to your team about each service item’s value to the client and her pet’s wellbeing and ask yourself if, in this light, the service isn’t worth more. This exercise helps you and your team explore the limits of what all of you are comfortable charging, what your clients may be willing to pay, and eliminates untapped opportunity for revenue.

Price Appeal

All of us have learned the power of specials like two-for-one, half off, buy-one-get-one-free, and so forth. We also know how much competitors’ pricing can influence our clients’ decisions to buy from us. Once you know the minimum you need to charge for your services, and then how much you and your team believe the service is worth, weigh this knowledge against what prices the market will bear and what prices or price packages may be attractive to your clients.

When deciding how to make your prices more appealing, don’t be afraid to steal from other businesses that have successfully experimented with ideas that work. Here are some of them:

Rewards Programs: Companies like Vet2Pet have rewards programs that are proven to drive client engagement and practice revenue.

Time-of-Day Discounts/surcharge: Practices are typically extra busy in the morning and in the evening when inpatient cases are going home. Would a cheaper, middle-of-the-day fee schedule help pull the strain off your team, even out your caseload, and ultimately allow everyone to be more productive?

Same-Day Service: Here’s an observation that I’ve made. Many practices have policies in place to charge clients more money if they are ´squeezed into the schedule´. The policy is meant to discourage clients from booking appointments frivolously (it’s also supposed to compensate the team for their extra work, but no company that I know shares the price increase with the team). But same-day surcharges do not stop clients from booking same day; rather, they usually just mean that the client comes in for service, but comes in mad because they had to pay more. My theory is, if clients are already paying the same day surcharge, why not charge more money for all care booked on the same day? Airlines do it. Hotels do it. It´s not as though the pricing strategy has not been tested.

Package Discounts: If you learn that your existing service bundle is already profitable, you can offer add-on services for nothing more than Direct Costs+ Desired Profit. Essentially this means that you can have two prices for one service. A more expensive one when it is needed ala carte for the patient’s care, and a more attractively-priced lower one when it is purchased as part of an existing bundle like a wellness exam with vaccines.

Incentivize Client Behavior: We could save tens of thousands of dollars of payroll if our clients agreed to get text message follow-ups instead of phone calls, if they scheduled their own appointments, or if they checked themselves in. Why not incentivize clients to onboard technology that ultimately saves us money and helps us manage our communication and caseload?

Memberships: Let’s face it, not all of your clients are equally as compliant. Some are fully invested in doing as much as they can for their pets, others, not so much. Would a special pricing structure for these extra special clients incentivize even more sales and greater loyalty? Some practices offer monthly memberships that allow clients to jump to the front of the line when they need something and get preferential treatment when they require same-day care. Sound crazy? Ever hear of TSA-preapproved security-check access or any of the other programs that airlines sell to clients in exchange for access to airport clubs, prioritized boarding, more legroom or luggage space?

Conclusion

In 2020, pandemic related stimulus programs, supply chain disruptions, a very tight labor market, and quantitative easing spurred an inflationary cycle. In response, the Federal Reserve introduced a series of aggressive interest rate hikes that, combined with slow global growth, and a volatile energy markets, risk pushing the U.S into recession in 2023. Veterinary businesses can expect ongoing high costs, higher wage demands until the labor market loosens up, and the significant possibility of slow-to-no growth.

If you decide to raise prices, ensure that the changes you make cover costs, include the input of your team, take into consideration your business’s value, and work to incentivize responsible companion animal care through third party financing.