There are a number of great ways to finance veterinary care. Help your clients discover them all! Available client financing takes the pressure off your team, improves compliance, and dramatically grows practice revenue.

Why Payment Options?

Need

In a recent VitusVet survey of roughly 800 veterinary practice owners and 200 managers, professionals agreed that regional pockets of COVID-related recession were increasing clients’ interest in payment options.

-

- 52% believed that pet owners would seek out more ways to pay for veterinary care as the recession deepened.

- 17% said that clients were already asking for more payment options.

Growing Popularity and Interest

According to a Bayer study, 45% of pet owners said that they had interest in some form of monthly installment plan to pay for veterinary care. Employment Benefits Advisor reports that 1-in-3 Fortune 500 companies offer their employees some form of pet health insurance as a way to attract and retain quality team members. The Society for Human Resource Management (SHRM) reported that in 2016, 9% of organizations offered veterinary pet insurance; that was up 5% since 2011. The number of American pets insured has been growing steadily over the past few years by as much as 18% annually and according to industry insiders, 2020 will see a record 40% increase year-over-year in the number of pet owners signing up for an insurance plan for Fido or Fluffy.

Dramatically Improves Compliance, ACT, and Number of Vet Visits

In a 2014 study conducted by the University of Florida, pet owners whose pets were signed up for veterinary wellness plans outspent their counterparts by $530 per year. In 2015, JAVMA reported that National Veterinary Associates’s clients that had wellness plans outspent their counterparts by 58% in medical expenditures and 28% in non-medical expenditures. Better still, these clients visited the vet 67% more frequently than they did before they had the wellness plans. Patients whose wellness plan included dentistry were 9 times more likely to receive annual dental prophylaxis than their counterparts.

Improves Our Relationship To Our Clients

Clients’ inability to pay for veterinary care is emotionally exhausting for everyone involved. When clients don’t have ways to pay for good pet health, doctors have to dilute the quality of their medical treatment plans; team members find themselves apologizing for care, rather than boasting about it; and an added ickiness of mistrust and embarrassment seeps into client interactions. But when money concerns are taken off the table, veterinary professionals and clients have more room to come together and to talk about what’s best for the patient at hand, doctors can display their real medical and patient care expertise, and patients can receive the proactive and humane treatment they need.

Kinds of Options

Payment options can be divided into two groups: those that cover anticipated and unexpected costs (like pet insurance and wellness plan options), and those that cover costs when services are rendered (like payment plan and financing options).

Anticipated Cost Options

Wellness Plans

A wellness plan is usually a package of annual services sold to patients based on species, age, and the patient’s medical risk assessment. They typically include an annual examination, core vaccinations, parasite screening and prevention, and early-detection lab work, but all manner of combinations abound. Costs vary, but they are usually in the $35-$50-per-month range. Wellness plans can be managed in house or, increasingly, by third parties like Vetbilling.com. Insurance companies like Nationwide have a variation on this theme: they offer low-cost monthly plans that reimburse clients a percentage of their pet’s annual wellness care costs. For more on wellness plans, visit the Partners for Healthy Pets website where you can find a variety of templates and models to jump start your thinking.

Loyalty Points

Veterinary practice loyalty points have been growing in popularity for some time. Dr. Staci Santee of Vet2Pet is one of our industry’s most enthusiastic loyalty-rewards-points evangelists. She built an app that allowed for loyalty points and then perfected the model in her own practice for two years before making it available publicly. You can read about the success she and other Vet2Pet clients have had using loyalty points to increase spending overall, but to save clients money on individual purchases by going to her business blog page. PetDesk is another industry stalwart with its own list of rewards-points success stories. It has been shown that veterinary apps can increase a practice’s annual production by as much as 5%. One PetDesk case study handily summed up the potential benefits:

“Six months after implementing PetDesk Loyalty, the clinic saw a major shift in their customer base. Now 2 out of 3 new clients are above average spenders and the new high spending average increased by an additional $100! Not only does PetDesk Loyalty incentivize new clients to spend more and come back more often, but existing clients that were previously above-average spenders are now spending 20% more!”

Pet Insurance

According to the North American Pet Health Insurance Association (NAPHIA) there are about 20 companies providing insurance to North America’s companion animals. Currently, 2.5 million U.S. pets are insured, a number that has increased by 15.8% annually for the last five year. The number is forecast to continue to grow through 2025 due to an increased awareness of pet insurance and animal humanization trends.

At-The-Time-Of-Service Cost Options

Credit and Health Cards

In addition to standard credit cards, clients can turn to companies like CareCredit, a financing company that offers credit exclusively for human and veterinary healthcare services. CareCredit has a streamlined way for clients to apply and offers a variety of payment packages designed to keep costs low.

VitusVet and Splitit Installment Services

Companies like VitusVet have partnered with installment payment service company, SplitIt, to allow clients to manage a payment plan on their existing credit card. Clients simply choose the existing credit card they would like to use, pick the number of installments they would like to make, and VitusVet/SplitIt manage the rest. Clients do no incur interest payments on the entire debt all at once, but only on that amount of money that is due during a particular installment period.

Vetbilling.com

This third party payment company, exclusive to the vet space, has been gaining popularity year-over-year. It allows veterinary practices to write payment plans any way they would like (though Vetbilling provides guidelines to insure that clients do not default) giving practices great flexibility to help them manage client financial need on a case-by-case basis. Once the payment plan has been written, Vetbilling manages the collection process so that veterinary professionals never have to switch roles from a provider of care to collections. The company has been expanding its services as it grows and offers free, 30 minute, virtual appointments for you and your practice team to learn more about what they do and how they can be of help.

Communicating Payment Options To Clients

We have everything to gain by making clients more aware of the many options available to help them pay for our care, but be careful of throwing too much information at them at once. Studies show that too many options paralyze consumers, so if your answer to finance communication is a welcome folder packed full of brochures, you’re getting nowhere fast. Instead try these strategies:

Introduce Your Clients To Pawlicy Advisor

Pawlicy Advisor is a veterinary insurance marketplace. The company provides free assistance to pet owners trying to decide on the right policy for their family and their pet. Pawlicy is highly effective at helping clients pick the right pet insurance. Their advisors spend time getting to know the client, learning about the pet, and the client’s expectations for healthcare and cost. That can be a big departure from the harried amount of time we spend on the topic because we’re usually so busy with caseload. Clients appreciate a consult with Pawlicy and it shows in the number of clients that sign up for pet health insurance after a meeting. Pawlicy Advisor has a conversion rate that’s 10 times better than our in-house attempts. You should explore how Pawlicy can integrate into your workflow for educating new clients and pet owners. I think you’ll be impressed by the model. The company offers free lunch-and-learns to veterinary practice teams eager to learn more.

Encourage Team Members To Use the Financial Products

The best promoters of veterinary financial services will be those that have had a great firsthand experience with them. Consider offering pet insurance to your employees and paying for all or a portion of it. Employees that have had positive experience with a financial instrument end up being great salespeople for the product.

Share Success Stories

At one of the practices I work with, we’ve seen dental compliance triple since we started offering financing for the service through Vetbilling. At another, VitusVet’s two-way text message service reduced phone calls by 70% and their SplitIt partnership has allowed for dozens of treatment plans to be billed out in installments. Loyalty points, too, have helped our clients reduce their veterinary costs. These kind of success stories jazz the team. Help spread the word throughout the hospital. Get team members that are most closely associated with each success story to tell the tale in their own voice as a way to draw more people into the narrative and to keep the messaging varied.

Make Direct Recommendations

After watching hundreds of client/vet professional interactions, I’m convinced that the best way to increase compliance and capture a sale is to make a direct recommendation. Take time to listen to clients, learn about their needs and those of their pets, and then tell them what you think they should do. If the client is dissatisfied with your recommendation, you can provide additional options, but never lead off with a list of what’s available and then ask the client to pick. Not only is this way of communicating services ineffective, it distances you from the client and may passively suggest that you don’t care.

Resources:

Pawlicy Advisor: This veterinary marketplace offers clients a wide selection of pet insurance policies to choose from, they identify the clients and pet’s specific needs, and then make a recommendation for the best policy. The service is free and pet owners that contact Pawlicy Advisors are 10 times more likely to buy a policy. Reach out for a lunch and learn to help your team members understand the service better.

Nationwide Pet Insurance: This pet insurance company is one of our nation’s oldest and most trusted. They offer two styles of coverage that appeal to a wide variety of consumers. Provide clients a link to their insurance comparison tool to help them decide which plan is best.

NAPHIA: The leading source of pet insurance information in North America.

Apps:

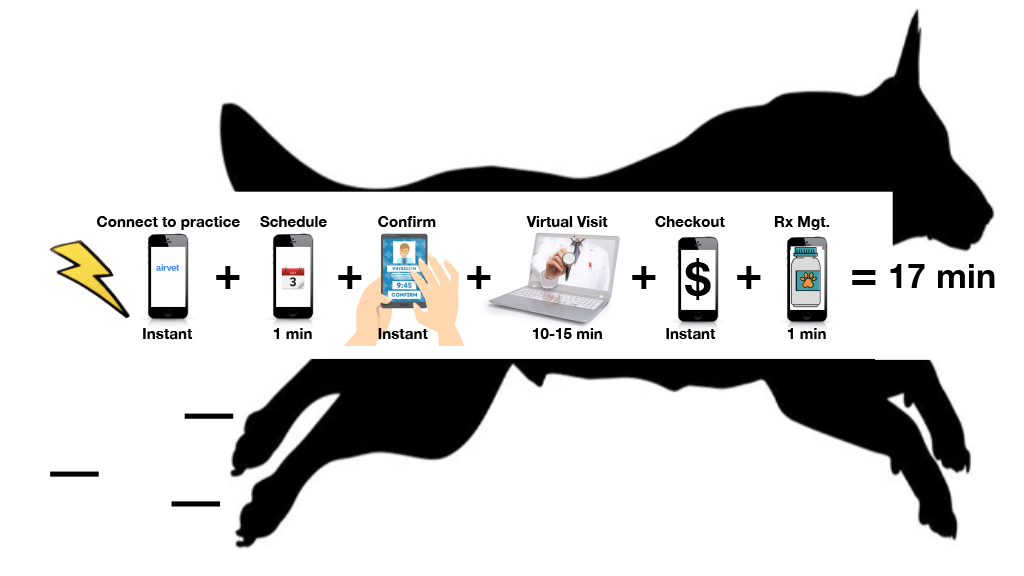

VitusVet: Two way texting, wireless payment options for faster curbside care, and installment payments through existing credit cards are just some of the perks.

Vet2Pet: Dr. Stacee Santi, owner of Vet2Pet, is a part of our industry and eager to do whatever she can to help us all succeed. Learn more about her and her company here. Also, be on the lookout for her on the conference circuit. She’s great!

Vetbilling.com: A friendly, supportive, and ethical sales team make this company a joy to contact. Reach out and start a relationship with this supportive, helpful org.